Jan 18, 2017

Numerous foreclosures suggest that cities and states do not get the residential or commercial property taxes they require streaming into their coffers, and they experience a spending plan crisis themselves as an outcome. These cities and states, then increase home taxes on the staying property owners, which then puts even more stress on individuals who are currently having a hard time to make ends satisfy.

If you’re among the many suffering under the installing pressure on costs, home loans, and taxes, you might wish to consider your funding alternatives. Instead of paying thousands in charges and late costs, you might wish to fund your taxes to supply a little monetary relief for you and your household. Here are 3 ideas for funding.

- Comprehend the repercussions of not paying your house taxes.

A tax lien basically indicates that whomever you owe taxes to have a legal claim on your residential or commercial property. In the long term, a tax lien indicates that your house can be offered out from under you in order for the county to collect on the back taxes.

The longer you wait to pay your taxes, the more the late charges add up. For example, by the time you put together the cash to pay a $10,000 property tax, you may end up paying another $2,500 or more due to late charges and interest costs.

- Discover a reliable real estate tax lender to assist you.

There is a way out of your tax predicament. There are businesses who concentrate on settling property taxes and associated late costs. You’ll still be paying interest on a loan with the tax funding business, however, the financial obligation is more manageable than it would have been in the hands of the tax assessor.

After the lender loans you the money and you settle your taxes and late charges, the lender takes control of your tax lien. Because the tax lender will own your tax lien, make sure you do your research and find a reputable lender to use.

- Stay present with your loan payments.

When you get a tax lender to assist you, make sure that you remain current with your loan payments. Since the lender owns your lien, you may still lose your house. Do not deal with a real estate tax loan as a long-term service to your issue; treat it as a short term substitute that briefly resolves your tax issue as you get back on your feet.

By following these 3 ideas, you will be well on your method to recuperating from your home or business tax crisis. Dealing with a respectable tax lender will conserve you countless dollars as you solve your monetary issues.

Those who fail to maintain their property taxes are the people who provide us with the opportunity to invest and deal with tax liens and deeds. Unfortunately, some people do not react fast enough, give up or just are unable to resolve their issues. When that happens the county will take over that property and the county looks to those of us who understand the tax lien and deed business to help them out.

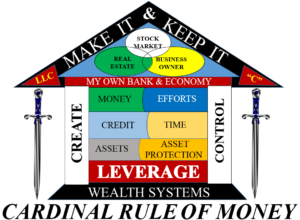

The best way to make money in any environment is to follow the CARDINAL RULE and make your money work for you.

God Bless and remember…

Prosperity is the name of the game…

Get started…Create Your Own Economy

MAKE IT AND KEEP IT!!!!