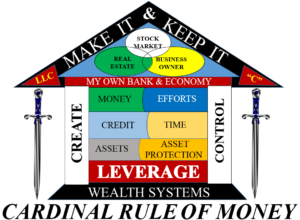

Our program is developed for the everyday person who does not have time to spend tied to a computer researching, analyzing, and crunching numbers. By eliminating all the fluff and unnecessary craziness, we offer realistic, non-theoretical, strategies to help you manage your money. The Make It and Keep It Wealth System is developed in a way that made it simple enough to teach it to my teenage children. My 14 year old will start trading next year and my 19 year old is already trading.

Through our program, we guarantee that you will be provided with the exact information and strategies needed to grow and manage your finances. You control your money, your trades, your time, and are responsible for learning and applying the material. We make it easy for you to access the information to review and practice, as well as the option to reach out for clarification on any strategy.

In reviewing the different plans, you will notice how these programs are designed to work around your schedule. These systems are developed to fit your time, money, and personal approach. Our Options classes are only 10 hours long, making it manageable for you to fit them into your daily routine. Additional resources are also available for those who want to go into further detail on relevant topics.

The fact that you are concerned by the risk is a good indicator because it shows you will take the necessary time to properly learn the material. Our videos are available for you to watch as many times as needed, we encourage everyone to participate in our Trading Pit, and listen to the recordings. The system is developed with the idea of greatly reducing risk and enhancing returns.

Although the SEC requires you to have at least $25,000 to trade any time every day, there are legal ways to trade with less funds. Brokers have different set ups allowing you to trade within certain parameters. Make It and Keep It systems are developed to allow you to trade regardless of your account size. If you would like to discuss this topic, please Contact Us.

Believe it or not, very little math or financial knowledge is necessary to start learning how to trade options.

I have found that those who have never traded before learn and understand the information better than those with experience. The new trader doesn’t have any bad habits to eliminate. Some members start live trading after 2 weeks, others wait 6 months. The system is designed to fit with your schedule and personal approach. The more you study and practice, the sooner you can expect to be making live trades.

Technically speaking Options are worthless and nothing in and of themselves. Options are derivatives of an underlying security such as a stock or ETF.

Think of Options traders as the spectators at a sporting event and the stock traders as the players on the field.

The definition of an Option is a contract that gives the owner of the option the right, but not the obligation, to buy or sell a set number of shares of a particular stock at a fixed price (strike price) for a specific period (expiration).

Not all stocks have options associated with them, but those who do have to meet certain criteria.

* The underlying equity must be listed on an approved national stock exchange

* The underlying has a minimum price of $3 per share for five consecutive trading days prior to being listed

* At least 7 million publicly held shares must be outstanding, not counting those held by directors or 10% plus holders

* There are at least 2,000 shareholders.

Options cannot be listed for trading following an IPO until after 5 trading days.

Liquidity has various meanings. I use it to determine volatility and whether I should enter a trade. I look at the premium spread (bid-ask) of an option to determine the volatility, and thus the liquidity of the trade.

When the premium spread is larger than normal it tells us that the market maker is uncertain about how to trade and where he/she will me the money on the underlying to offset any risk (hedge) on the trade,

If the market maker is unsure then I most definitely do not want to rush into that dark room. Remember that as option traders we follow the market and we do not dictate the market.

The wash-sale rule prevents non broker-dealers from selling stock or securities (including options) at a loss and reacquiring roughly identical stock or securities within a 30-day period before or after the loss.

Check with your accountant for your particular situation.

Yes. In American Options, unlike European Options, you can exercise your option to buy or sell at any time. When you are in a Short position and you do not have the right, but the obligation, be careful that the holder of the option can exercise against your Short position as well. However, you will find that most Short positions expire worthless without ever having been exercised.

Technically speaking you should be able to turn around and sell it immediately, but different brokers may have different instructions. Some brokers require that the stock purchase settle, which could take 3 days, and others will allow you to sell the next trading day. Be sure to check with your broker for their requirements.

You possess the right to exercise your Long position, Call or Put) before expiration, but if your Long position closes ITM (In-the-Money) you could be assigned the obligation to perform.