Sep 4, 2010

Most people do not seem to differentiate between trading and investing. Yet understanding the difference is a key factor in making money. When you invest you are essentially allocating a considerable amount of time for your money to make money for you. When you trade you are placing a greater value on your time and you should be looking for a quick entry and exit into any asset.

Investing is not a bad thing considering several factors. The main factor to consider is the economic situation as a whole. Does the state of our economy allow for you to park your money into an asset; and is that asset likely to forge positively ahead making your investment into the asset and into the time period worthwhile. That is the consideration to occupy your thinking process. Let me illustrate.

You should have already decided how much money you wish to generate for the next twelve months and calculated the monthly, weekly, and daily average to achieve that goal. You decide that you want to make $100,000 this year and you decide there are 52 weeks times 5 days per week allocated for work which equals 260 work days for the year. You subtract 10 days as holidays or holy days and settle on 250 work days for the year. When you divide $100,000 by 250 days you arrive at the magical $400 per work day. Keep in mind this is an average – one day may generate $600 and the other $200, but the average must be maintained. Do not wait until the eleventh or twelfth month to try and catch up with your average.

Now that you have your number you decide to pursue the process of making money. If you decide to park $10,000 into a stock or into a piece of real estate you must ask yourself, is the market situated in such a way as to generate enough equity in that stock or property over that period of time so as to allow you to reach your goal.

You park your money into a single family residence in need of repair and

you hold it for two months (8 weeks times 5 work days per week equals

40 days). At the end of the two months you should generate $16,000

in order to maintain your daily average of $400 per day ($400 x 40).

While considering the example above you must be realistic – will this property sell within two months or will it stretch to three or four. Assuming you calculate that your profit for two months will be $16,000, but the house sits on the market for four months. After four months you generated the $16,000 estimated – you have now averaged a daily return of $200 thus greatly hindering the accomplishment of your goal. It is a very brief example as it does not consider expenses during that period of time which must also be recovered.

The same concept applies to a stock. If you put $10,000 into a stock and wait for it to make an upward move then you must follow the same calculation as above to decide if it is a wise pursuit. No additional expenses are associated with this investment.

In analyzing real estate or stocks you must also consider the risks involved. One thing about risk which many seem to overlook, or fear to discuss, is that the longer you have your money parked and at the discretion of another person or persons or the particular market the higher the risk of loss and less the chances of gain.

If your investment will allow for your minimum daily average return then you should invest, otherwise you should look into a better method of generating money.

When it comes to quick turnover of money and to generating quick returns I recommend options. With options you can be in the trade for 1 minute to 1 year, but the risks are much lower than a stock; and that is simply achieved by the fact that the money parked into an option is considerably lower than that required for a stock purchase.

Options allow you to follow a stock with less risk of money and you are able to better enter and exit the market in a shorter time frame with greater returns. Long term traders aka investors, have a rough time accepting this concept because they are not willing to change, people resist change. Many, if not most, stock brokers and agents do not deal with options because they do not understand them and they are afraid of them. To hide the real sentiment they tell you, “investing is for the rich and options are for those who are uneducated.” An actual response I received from an agent. I asked him how much money he had made for the year with investing. He proudly declared he had a personal portfolio worth $500,000 – not a bad amount, but it was at risk when the market roller coaster was turned on mid year 2008 – it was paper money not real money. His portfolio dropped $100,000, but those trading options generated 2-9 times that amount in profit as a result of the topsy turvy market.

Real estate agents are the same as stock agents. Most only know what they studied and cannot comprehend or appreciate how to pursue the many facets of real estate investing. Do you know you do not have to own a piece of property to benefit from it? Yes it is legal; and we are not selling the London Bridge. It is optioning real estate. Many agents cannot seem to comprehend that or will not deal with it. Similar to a stock broker who does not deal with options – many cannot deal with options per the Securities Exchange Commission.

A bird in the hand is worth two in the bush. The same idea applies to money. One dollar today is worth two tomorrow. Options allow you to hold on to your money and generate income on a regular daily basis.

Stocks and real estate trading are similar. Just keep in mind that when the market is unsure of itself and it is riding a rough roller coaster it is best to trade rather than invest. In a typical, reliable, and average market as well as a great and healthy market you can invest as well as trade and thus benefit from both activities. For the time being stick to trading and keep your money close at hand and insure its every move.

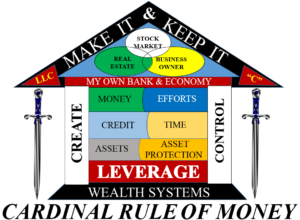

The best way to make money in any environment is to follow the CARDINAL RULE and make your money work for you.

God Bless and remember…

Prosperity is the name of the game…

Get started…Create Your Own Economy and

MAKE IT AND KEEP IT!!!!