Jan 5, 2017

Rules, rules, rules. One of the SEC rules concerns the ability of the everyday trader to manage his/her own money. The rule states that if you have less than $25,000 in your trading account then your trading will be limited to only 3 trades every 5 business days. So long as you stay below the 3 trades every 5 days then your account will be labeled as a non-pattern day trading account and you can continue to trade under the restrictions. However, woe to you if you make 4 trades within those 5 business days. In that event your account will be labeled as a pattern day trading account. Once you reach the pattern day trading label your account will be branded as such permanently and you will not be able to make any trades until your account has a daily balance above the $25,000.

Is this good or bad? Is it for your benefit or detriment? Well, let’s take a look.

The argument for the rule is to protect the individual investor/trader from the big bad market. The last few years many traders opened accounts to personally manage their money and not to use an investment firm or financial manager or advisor. It is true that many people have lost millions and billions of dollars in the market as a result of jumping in and getting caught up in a whirl wind of market behavior of which they were not accustomed or knowledgeable of how to avoid or manage the situation.

The anti-rule traders argue that the rule is a hindrance and not for their benefit. They see it as a product of the lobbying efforts of the big investment banks and financial advisor and management world who think they are the only ones qualified to manage your money. If you manage your own money then you will not use their services and they will not earn the fees for managing your money.

“Well, we can’t have people taking their money management chores in their own hands. The average person is too stupid to manage his/her own money. They don’t know how to play this money management game. They can go out and earn it and give it to us and we will take care of its management.”

Many people see the SEC rule as nothing short of the SEC doing the bidding of the big boys. Many view this as the government reaching into their lives and telling them that they are too stupid to manage their own money.

Is there a problem with letting people take responsibility for their actions and their own money? Do we really need the government to tell us how to spend our money? The reality is that most people are qualified to manage their own money with a little bit of effort to gain the knowledge and the experience to manage their own money.

The part that scares the big boys is not that you may lose your money, but that they will lose access to your money. They are afraid that you will realize that you can make 10% to 300% return by managing your own money. They will brag about making you 2% to 12% while millions are actually made and paid out for their fees and you are left holding a 5% return. After you pay taxes on the profit and you take into consideration the rise in the cost of living, your money actually lost money if you made anything below 8%. That 8% is a rough estimate, but the fact remains that even if your manager made you 12% then your money only grew at a rate of 4% at best.

Is it realistic that you will make 300% or even 20% per year? Yes it is, but neither I nor anyone else can guarantee your returns. That is why you must first gain the appropriate knowledge and the appropriate guidance on how to apply that knowledge. Of course, the SEC must get out of the way to allow you to use that knowledge and to do what you want with your money. My argument is this, if you are qualified enough to go out and earn your money then you are qualified to learn how to properly manage your money. If you make 6% the first year then you should have picked up enough experience to parlay that experience into 30% for the second year. By year 3 you should be on track to double your account every 1-5 years. Now imagine teaching your children how to do that as they grow up and before anyone has the opportunity to convince them that they are too stupid to manage their own money, and essentially their own lives.

Now you really see who is truly afraid, it’s the big boys. So long as you think you can’t manage your money then you will use them; and that is what they want. Once you know the truth, and worse yet, teach it to your children, then the big boys just lost a chunk of money and income forever. For now, even with this rule, you can still manage your money and you can make major progress in your financial situation.

Do not let fear, or this SEC rule, stand in your way. Pursue your prosperity and your future financial freedom by learning how to properly manage your own money to exponentially generate wealth. Follow the link below to read more about this rule from FINRA.

http://www.finra.org/investors/day-trading-margin-requirements-know-rules

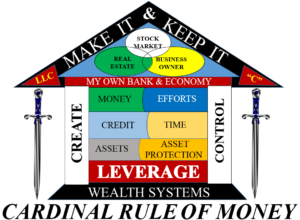

The best way to make money in any environment is to follow the CARDINAL RULE and make your money work for you.

God Bless and remember…

Prosperity is the name of the game…

Get started…Create Your Own Economy

MAKE IT AND KEEP IT!!!!

By: Louis Monsour