A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

J

A method of price charting developed by the Japanese centuries ago which displays the open, close, high and low of the day in a manner much easier to read than all other price charting. The method we use in the Make It and Keep It Wealth System program.

A bond with a speculative credit rating of BB (from S&P) and a Ba rating (from Moody's) or lower.

K

The rate of change in an option's theoretical value for every percentage point change in volatility.

Sample Description

L

Long Term Equity Anticipation Securities, are options which have an expiration date beyond nine months. LEAPS apply to Calls and Puts.

Term describing one side of a position with at least two sides. A Long Call (Put) or Short Call (Put) on their own are not referred to as legs. When dealing with a spread then the Long and Short positions are each referenced as legs.

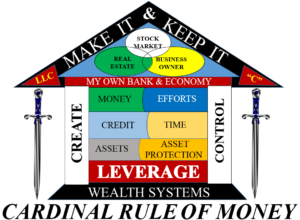

Using a very small amount of money to control a much greater valued security. The money used to control the security is insufficient to purchase the security.

An order to enter a trade placed with the broker to buy or sell a stock or option at a specific price.

When a trader buys a Call or Put option hoping to make a profit as the underlying security moves up (Call) or down (Put). When you are Long an Option you are looking to go aLong with the stock price movement.

When an investor purchases and now owns shares of a security.